Banner message can go here.

OAD helps PE firms de-risk post-acquisition chaos by giving you deep behavioral insight into leadership teams, cultures, and compatibility — before, during, and after the deal.

You don’t need more spreadsheets or financial models. You need to know if the people at the top can actually work together.

Most deals fail post-close — not because of market shifts or macro conditions, but because of the people. Mergers that look great on paper unravel when cultural friction, ego clashes, and misaligned leadership styles go unchecked. The cost? Stalled integration, lost momentum, missed financial targets — or worse, full-blown turnaround scenarios.

OAD helps you see the invisible before it becomes irreversible.

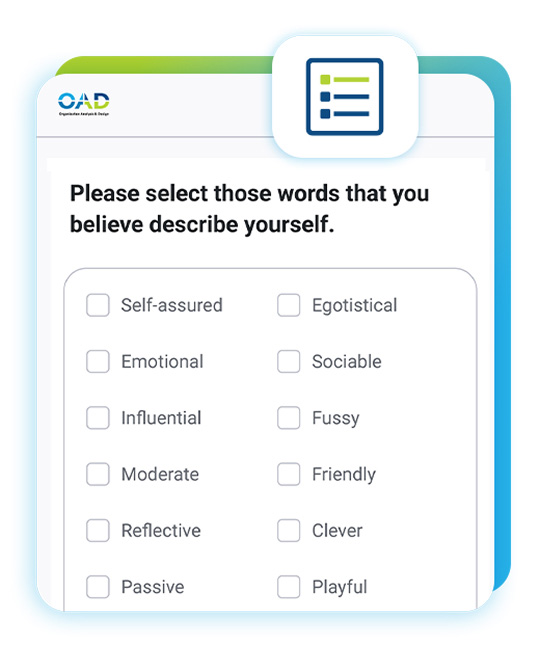

With our 10-minute survey and proprietary behavioral models, you can:

When you’re acquiring a business, you’re not just acquiring assets. You’re inheriting a leadership structure, a culture, and often, deep-rooted interpersonal dynamics that can either make or break your investment thesis. OAD gives you a lens into all of it — fast.

Use Cases:

Yes. Most PE firms use OAD portfolio-wide. You’ll have a centralized admin dashboard to manage assessments, view reports, and track progress across companies.

OAD flags both using stress indicators, mismatch scores against role requirements, and interpersonal compatibility risk across teams.

Absolutely. OAD reveals if a person is actually wired to lead in high-stakes, high-growth environments — or if keeping them in place is likely to backfire.

Yes. OAD helps you understand team interdependence, find talent gaps, and avoid destabilizing the company during sensitive transitions.

The survey takes 10 minutes per person. You’ll receive results immediately. Full team assessments can be completed and reviewed within 24–48 hours.

No Risk. No Credit Card. Just Answers.